This is a synopsis of our view about cryptocurrencies, a controversial yet exciting new asset class.

- What is the contribution of cryptocurrency to our outperformance

- We only started to invest in cryptocurrencies earlier this year once adoption accelerated among institutional and corporate players. Thus, this investment has no bearing in our long-term track record.

- On a year-to-date basis, however, our cryptocurrency holdings contributed roughly a third to our outperformance relative to our benchmark, the MSCI ACWI.

- 3-point investment thesis on cryptocurrencies

- We accept that investing in Bitcoin (BTC) and Ethereum (ETH) is not a conventional way of investing because these are closer to currencies than shares of a company. Over the long term, however, we see blockchain technology as a gateway to a new decentralised digital platform like Amazon, Google and Facebook once turned physical economic activities into centralized digital activities. Similarly, it is our view that blockchain technology is currently turning certain centralised digital activities into decentralised digital technology. We believe that we are only at the foot of the hill of what is to come. We asked ourselves two questions: 1) do we want to participate in a decentralized digital economy powered by blockchain technology? and 2) what would be the highest quality way to participate in this emerging technology? In our view, BTC and ETH are the highest quality vehicles currently available to participate in this revolutionary blockchain technology. While BTC is closer to currency and potential digital gold, ETH coin is closer to a share of the Ethereum network.

- Attractive fundamental characteristics

- BTC is a speculative hedge against inflation with store of value and diversification potential.

- A disruptive technology with profound financial implications: significant network value for ETH.

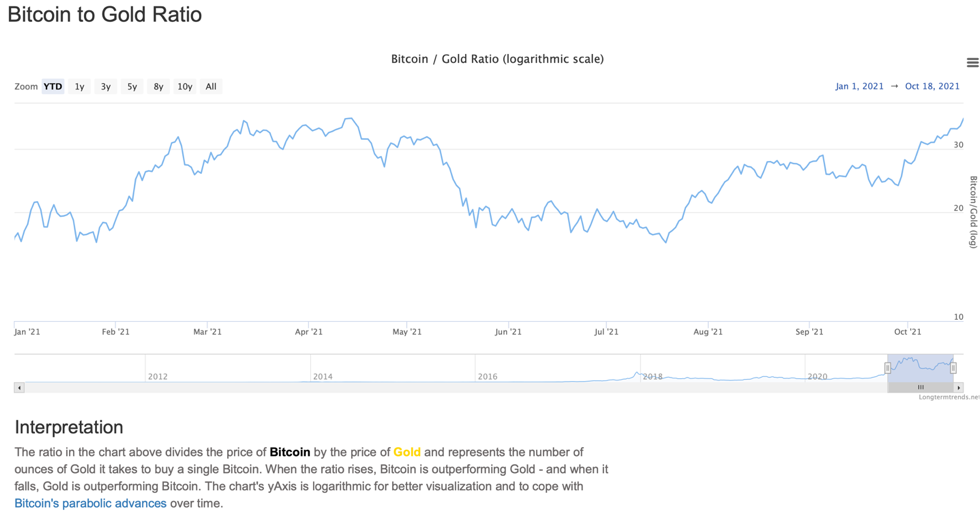

- An example. This year 2021 has seen a relentless rise in inflation as well as inflation expectations due to Covid-related supply chain shortages, pent-up demand, and central banks printing money with abandon. For the first time since the financial crisis of 2008, these concerns around inflation are credible, requiring investors to deploy hedging strategies in their portfolio. Yet, the price of gold has declined 6.1% this year to $1,792 a troy ounce while that of BTC has more than doubled (127% to be exact) to a record high of $67,000 as of October 20th, 2021. A $1,000 investment in gold at the turn of the year would be worth$939 today whereas the same $1,000 invested in BTC would be worth $2,270 today, assuming the investor held it throughout this period. The chart below shows the extend of BTC’s outperformance over gold year to date.

- Early adoption potential

- Early adoption curve as non G7 countries in Asia, Latin America and Africa gain a credible avenue to leapfrog into decentralized finance (more transparency while avoiding corrupt government officials and exorbitant bank charges; faster and more secure money transfers).

- Sustainable retail demand from developed markets could boost institutional adoption in the US and other developed countries.

- Early adoption potential

- Risk management around cryptocurrencies

- We are aware of the risks and volatility associated with cryptocurrencies. This is inherent to most asset classes early in their adoption curve. Accordingly, we manage our exposure through rigorous target weights and other risk control mechanisms (our defend in depth system).

If you would like to discuss more, please click here.

- Risk management around cryptocurrencies

Endemaj aspires to cultivate the evolving technological landscape by streamlining capital, thinking outside the box,and growing value on the back of our legal and financial expertise. Asset Management Companies in dubai As an investment house in Dubai, we look to identify and grow visionary ideas that have the potential to create a positive impact on a global scale.We are for the ambitious, the visionaries, the thinkers, the innovators.Investment House In Dubai